European Growth and Market Dynamics

Royalty financing and synthetic royalties are reshaping biotech and pharma funding in Europe. As venture funding tightens—Q2 2025 saw biotech venture capital drop to $4.8B, falling to pre-2018 levels—European companies are increasingly adopting alternative funding models. Notably, over 20% of global synthetic royalty and drug development deals now involve European players, a major leap in just two years.

This surge is propelled by the demand for non-dilutive, flexible capital—especially among mid-sized and family-controlled European biotechs keen to expand pipelines without giving up control or adding too much debt to their balance sheets. However, legal complexity and rigorous revenue forecasting are essential, as most investors and documentation standards are still US-based. Robust legal counsel and sector expertise are therefore critical for successful royalty financing in Europe.

What Are Synthetic Royalties?

Synthetic royalties allow a company to generate capital by creating a contractual royalty stream on its own drugs, without giving up equity or selling physical royalty rights. For marketed drugs, synthetic royalties are pegged to real-world sales, offering predictability for both issuers and investors—these deals generally feature lower royalty rates, capped returns, and minimal restrictions. For pre-approval, late-stage assets, synthetic royalty deals are less common and more expensive, with higher rates and stricter covenants to offset higher regulatory and commercial risks. In essence, synthetic royalty financing transforms future revenue into up-front funding, ideal for companies seeking non-dilutive capital while retaining asset ownership.

What Is Royalty-Backed Debt?

Royalty-backed debt is a hybrid structure: companies borrow against future royalty or sales streams rather than relying solely on operating profits. For products already on the market, royalty-backed loans take advantage of steady revenues, so companies gain flexibility, avoid equity dilution, and often enjoy lower interest rates. When arranged on late-stage, pre-approval assets, terms are tighter—higher royalty or interest rates, stricter covenants—to address increased development risk. Unlike synthetic royalties, royalty-backed debt remains a loan: ownership stays with the company, but investors hold a security interest in the IP and royalties, making this financing attractive to both issuers and investors seeking senior, asset-backed returns.

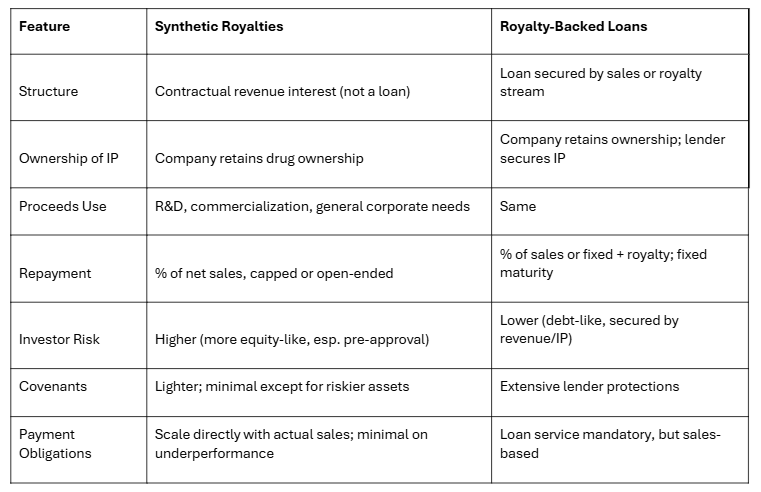

Synthetic Royalties vs. Royalty-Backed Loans: Key Differences

Steps Toward Implementation

Royalty financing, and especially synthetic royalties, have become critical tools for European biotechs navigating capital challenges while safeguarding ownership and strategic autonomy.

If you would like to discuss which alternatives suits your company best, please reach out at info@avance.ch

Use our interactive tool to get your value estimation now. Simply enter your key details and see the calculation.