How Tokenization can Transform Pharma Licensing and Royalty Financing

The pharmaceutical and biotech industries face a critical financing paradox: groundbreaking medical innovations require massive capital investment, yet traditional funding mechanisms create significant barriers to accessing the capital needed to bring life-saving treatments to market.

With VC funding a pre 2018 levels, (early stage) licensing has become the go-to financing mechanism. Global pharmaceutical licensing deals were valued at $152.2 billion in 2024 and growing at 5% annually. However, licensing is slow, complex cumbersome and only allows royalty financing to a limited extent.

What if, the developed IP , data etc that are at the core of a licensing agreement can be tokenized and put on a blockchain, allowing licensing deals to be made as smart programmable contracts (as NFT’s) that would allow for instant settlement and fractional reselling?

This would open up the industry to a larger pool of investor and capital that can benefit from the value created whilst the biopharma industry gets more liquid and access to more sources of capital. Currently intellectual property, licensing agreements, and future royalty streams represent substantial value but cannot be easily converted to working capital when companies need immediate funding for clinical trials or regulatory submissions.

Licensing Market Inefficiencies

The pharmaceutical licensing ecosystem suffers from significant structural inefficiencies that limit both access to capital and speed of transactions. Traditional licensing deals involve complex negotiations, lengthy due diligence processes, and substantial administrative overhead—with transaction costs typically taking a tens of thousands up to a million per deal and settlement times extending 30-90 days. Geographic limitations further constrain the licensing market. International investors often cannot participate in promising pharmaceutical opportunities due to regulatory barriers, currency complications, and minimum investment thresholds that exclude smaller institutional and retail investors.

Secondary Market Limitations

Perhaps most critically, pharmaceutical licensing agreements and royalty streams lack secondary market liquidity. Once committed to a licensing deal or royalty arrangement, investors cannot easily exit their positions or adjust their exposure based on changing market conditions or new clinical data. This illiquidity premium increases the cost of capital for pharmaceutical companies and limits investor participation. There are a few listed royalty aggregators that provide this liquidity but they can only be accessed through stock bundling their entire portfolio.

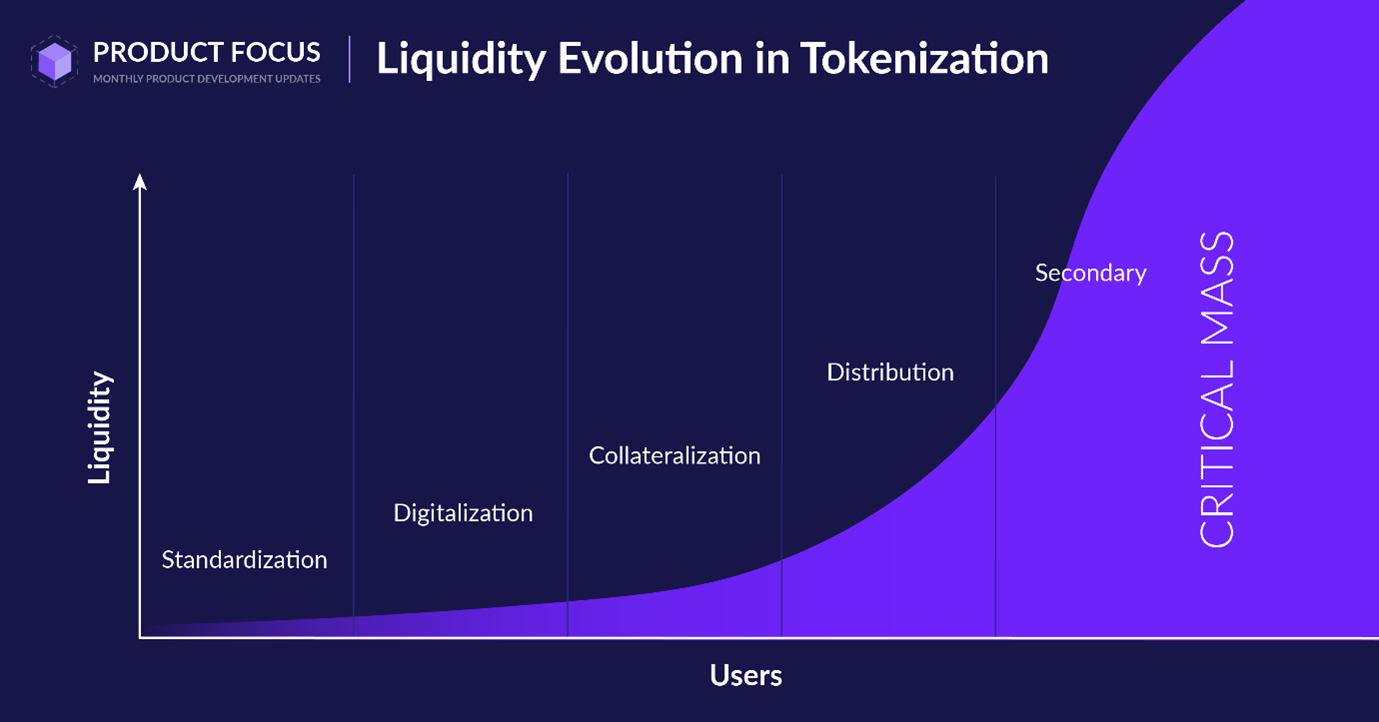

The Tokenization Solution: Transforming Pharmaceutical Finance Fractional Ownership and Enhanced Liquidity Blockchain tokenization fundamentally transforms pharmaceutical asset liquidity by enabling fractional ownership of licensing deals and royalty streams. Similar to successful real estate tokenization platforms like RealT, which has attracted over 7,500 global investors with minimum investments as low as $50, pharmaceutical tokenization can democratize access to biotech innovation. Smart contracts can automatically handle complex royalty calculations, milestone payments, territorial restrictions, and compliance requirements—reducing administrative overhead by up to 90%. This automation eliminates traditional intermediaries and accelerates settlement times from 30-90 days to 1-3 days.

Tokenization dramatically expands the potential investor pool from hundreds of specialized institutional investors to tens of thousands of global participants. This expanded access reduces the cost of capital for pharmaceutical companies while providing investors with unprecedented transparency through immutable blockchain records. The cost advantages are substantial: tokenization reduces transaction fees drastically once the initial licensing contract is put in place (initial legal, financial and valuation advice is still required).

In addition, tokenized pharmaceutical assets enable real-time price discovery based on clinical trial results, regulatory approvals, and competitive developments. Investors can adjust their positions dynamically, providing pharmaceutical companies with more accurate market feedback and potentially higher valuations for promising assets.

Current Market Momentum

The convergence of pharmaceutical financing needs with blockchain capabilities is already attracting significant market attention.

Hybio Pharmaceutical has partnered with KuCoin to launch mainland China's first RWA tokenization pilot.

With the current US Government putting crypto regulations in place and aiming to spur innovations in the space, momentum for this type of financial innovation is picking up.

At Avance, we are actively exploring the possibilities of tokenization of royalties as successful implementation requires sophisticated expertise in two critical areas:

Conclusion: The Future of Pharmaceutical Finance The tokenization of pharmaceutical licensing deals and IP represents more than a technological evolution—it's a fundamental shift toward more efficient, accessible, and transparent life sciences finance. Are you interested in exploring how tokenization could transform your pharmaceutical financing or licensing strategy? The convergence of blockchain technology with life sciences finance creates unique opportunities for forward-thinking organizations. We'd welcome the opportunity to discuss how these innovations could benefit your specific situation and explore potential collaboration opportunities, contact: jasper.evers@avance.ch

Use our interactive tool to get your value estimation now. Simply enter your key details and see the calculation.